When politicians say “we'll leave more money in people's wallets”, who are they actually referring to? And what does the other obligatory election promise of “we won't raise taxes” really mean?

When politicians say “we’ll leave more money in people's wallets”, it sounds like a forthcoming gesture towards ordinary people. However, given the logic behind such measures, it’s not always clear which group they’re actually targeting. Naturally, the most important aspect that ultimately decides this is which tax they want to reduce and who’s currently paying that tax.

Another equally important aspect is the real overall economic impact that this kind of tax reduction has. This depends primarily on who bears the real burden of the tax, which is known as incidence.

Could you give an example of that from current political programmes?

For example, the reduction in corporate taxes included in the ANO programme doesn’t usually lead to a reduction in the prices of these corporations’ goods, as some of their voters may assume; what it will do is quite reliably lead to an increase in the after-tax profits of these companies.

So yes, some people will indeed have more money in their “wallets”, but those “wallets” are more likely to be fat bank accounts. And those accounts probably won’t primarily belong to ANO voters, but rather to some of the members of the ANO party.

How is it possible, then, that rhetoric like this still works?

Rhetoric about tax cuts is often based on the idea that taxes are something the state “takes” from us rather than what they really are: an expression of a social contract that makes it possible to finance public services, infrastructure and a stable economic environment; in other words, the basic social conditions for everything else – including private enterprise.

In reality, it’s not a question of how much money someone has or does not have, but how we decide to distribute the costs of running society.

From the perspective of ordinary voters, progressive taxation would logically make much more sense. Where does this fundamental resistance to a measure that could finally begin to structurally redress growing inequalities come from? Who is fabricating this resistance and who is profiting from it?

Relative resistance to progressive taxation has deep roots in the Czech Republic. Part of the public still feels that taxes punish success and that a flat tax rate is the only one that’s fair. In reality, it’s more a question of framing – that is, how taxes are discussed, who leads the debate, and what interests are behind it.

If, instead of such prejudices, we simply looked at the empirical evidence, we would see that countries with more progressive taxation have higher social mobility, better services for ordinary citizens and, logically, greater trust in the state. This fact has somehow not yet reached the Czech consciousness.

Let's help change that with this interview. How does progressive taxation achieve better services and greater social mobility?

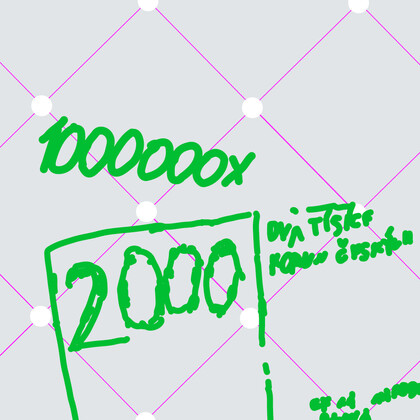

Economics is quite clear on this thanks to its consideration of utility functions. When someone earns 20,000 CZK a month and has to pay 2,000 CZK in tax, they feel it more than when we tax someone who earns 200,000 at the same rate of 10%. This kind of tax takes away more utility from a person with ten times lower income. This utility function of earned money evens out with increasing income or wealth.

Above a certain level, the utility of additional income simply ceases to increase for very wealthy people, while poor people use their additional income to buy goods that are mostly a matter of their very existence: food, housing, etc. These are things that, on the contrary, bring them enormous utility.

And that, in a nutshell, is the basic mechanism of how progressive taxation actually optimises the overall well-being of society.

What are the most common myths circulating in the Czech debate on taxes and the state – and which one do you think has the greatest impact on the long-term quality of life in the Czech Republic?

One of the most harmful myths is undoubtedly that lower taxes automatically promote economic growth. In the long term, low taxes often lead to the erosion of democratic institutions and deepening inequalities.

I would also mention the myth that the state is inherently inefficient and that the public sector only redistributes without adding value. Economics, which is not dominated by ideology, on the contrary, sees that the state is in a very good position when it comes to solving some major problems. Even the best-functioning economy leaves behind a lot of unintended consequences and market failures. At such times, the state is essentially the only actor that has the power to improve many aspects that directly affect our lives.

Could you give an example?

One such example is the existence of so-called externalities, i.e. the uncompensated effects of transactions or activities on a third, uninvolved party, which lead to market failure, i.e. the inability of an unregulated market to achieve an efficient allocation of resources.

Put more simply, negative externalities (such as air pollution) lead to excessive activity, while positive externalities (such as education) lead to insufficient activity. For example, if every citizen had to pay the full price for their education, including basic education, many people wouldn’t be able to afford it and they wouldn’t study, which would have a devastating impact on society.

This is where the state comes in, as it’s able to identify shortcomings like these in the market mechanism and has the capacity to correct them. Only then can society function properly, aspire to better services and, as a result, improve the quality of life.

One of the topics of this year's Inspiration Forum, in addition to Money, is Europe. Does it still make sense for the Czech Republic to keep the koruna, or are we already so economically intertwined with the rest of Europe that it’s more of a political gesture that exploits cheap patriotism?

From a purely economic point of view, the Czech economy is already so closely linked to the Eurozone that the koruna is beginning to seem like a rarity that makes less and less sense every year. Keeping the koruna therefore has more symbolic and political significance than economic sense.

It is important to realise that while we are missing out on some of the benefits of the Eurozone with the koruna, we are nonetheless still bearing its costs – most of our exports, loans and investments are in euros, so shocks affecting the Eurozone have long had a significant impact on our economy, koruna or no koruna.

What do you think is the symbolic or political significance of the koruna?

It’s a question of political identity and a sense of autonomy. However, this has less and less practical impact on real life. In reality, the Czech National Bank operates in an environment that is strongly influenced by the policies of the European Central Bank. The koruna simply doesn’t have much room to manoeuvre in the interconnected European economy.

So why do defenders of the koruna say that “the Czech National Bank will protect us from crises” or that “the euro will lead to price increases”? Which of these statements are based on facts and which are more likely to be fabrications?

The Czech National Bank undoubtedly has tools at its disposal that it can use to respond to shocks in the short term. But in a globalised economy, its room for manoeuvring is limited. We know from recent years that the real crises that affect us are mostly external – i.e. they’re ones concerning energy, finance and geopolitics. And in crises like these, a “domestic currency” won’t solve anything.

In terms of fears of price increases after adopting the euro, these are largely exaggerated. In other countries, the transition to the euro had only short-term effects, mostly in the area of small prices. The real factors that influence inflation lie elsewhere – in productivity, wages and competition.

So what are the real potential disadvantages of adopting the euro for Czech citizens?

It’s extremely difficult to quantify all the advantages and disadvantages of joining the Eurozone because there’s no good “counterfactual” – that is, it’s difficult to assess what would have happened if the new currency had in fact been introduced. Empirical analysis of the real economic impacts isn’t very helpful in this case, and it’s really more of a geopolitical issue – if we want to be an integral part of a prosperous Europe, I believe it would make a lot of sense to adopt the euro as soon as possible.

What positive effects do you think monetary policy can have in times of crisis, and what on the other hand does it fail to solve?

Monetary policy can mitigate the effects of crises – for example, by making loans cheaper or stabilising markets. But it can’t solve structural inequalities, budget imbalances or tax evasion. This requires effective fiscal policy and international coordination – areas in which we’re lagging behind. For example, the huge problem of the taxation of multinational companies, which, according to the latest estimates, transfer around 40% of their profits to tax havens, is something we could be much more active on within the EU or in the forums that are newly emerging in the UN.

We’ll move now to a short series of uncategorized questions that I think a lot of people ask themselves but are ashamed to admit it. I'll start with a tough one: What is the fundamental difference between cash and contactless cards – and why does it matter? Who can be harmed by digital payments?

It matters more than we think. Cash is anonymous and universally available. Digital payments are more convenient, but they create dependence on infrastructure controlled by private companies. Many merchants argue that they don’t want to accept payment cards because of high fees.

Every payment leaves a data trail, which means a loss of financial privacy. For most people, this isn’t a problem, but for some groups – the elderly, rural residents, low-income earners – the digitisation of payments can create barriers. On the other hand, from the perspective of preventing tax evasion, corruption, money laundering, etc., digitisation is obviously desirable.

How do cryptocurrencies actually work – if we were to explain them to someone outside the crypto community – and what real problem do they solve, if any?

Cryptocurrencies were originally intended to address mistrust in financial institutions, but in practice they tend to create new inequalities. The decentralised ideal has become a highly speculative market with little real benefit to the mainstream economy.

For the time being, banks can’t be bypassed – their role in providing credit, managing risk and ensuring stability is irreplaceable.

Will money be able to exist without banks in the future? Or will humanity manage to do without money completely before that happens?

Rather than the end of banks, we’re likely to see their gradual transformation into more data- and technology-driven institutions. Some traditional banks are still dependent on paper contracts and physical branches at a time when more modern institutions are able to provide services completely digitally.

Revolut, Wise and other applications work on the principle of bypassing banks. Does this fundamentally change the traditional financial system, or is it just a cheaper and more convenient gateway that has no potential to change the basic rules of the game?

It mainly changes the user experience, not the system itself. These services streamline transfers, reduce fees and increase competition, but they still operate within the same financial framework.

So what kind of application could bring about real change?

Real change would only come with a publicly managed digital infrastructure that would offer basic payment services without dependence on commercial banks.

So it would be managed by a central bank? In other words, should central banks issue their own digital currencies? And what would that change for ordinary people and businesses?

The issuance of a digital currency could be groundbreaking if two things could be combined: accessibility and trust. A so-called CBDC (Central Bank Digital Currency) could strengthen financial inclusion, reduce transaction costs and offer an alternative to private payment platforms.

It would, however, depend on the design. If motivations such as control or surveillance came to the fore in the design of such a currency, it would merely become a tool of financial control, the public would soon lose motivation to use it, and such a currency would lose its purpose. It would only have a purpose if it became a true public service.

Money is often portrayed as a neutral medium of exchange. You also examine it as a social relationship and an instrument of power. What does the history of money tell us about how our society is changing?

The history of money is actually the history of trust. Every currency only works to the extent that people trust the institutions that guarantee it. Money has never been neutral anywhere – it has always reflected the current power relations and social order.

And when the nature of trust changes – for example, with the transition from states to private platforms – the very meaning of money changes too.

And if you look at the history of currencies, from shells and metal coins to Bitcoin, what actually makes a currency “trustworthy”? And do these criteria change, or do the basic principles actually remain the same?

The one fundamental principle remains the same: a currency is trustworthy if we believe that we’ll be able to buy with it tomorrow what we can buy today. That’s why it’s so important today to control inflation, which in an unregulated environment is prone to economic spirals.

So what’s changing in monetary history?

Only the institutions that mediate that trust are changing – from monarchs and central banks to algorithms. It’s always a combination of stability, transparency and perceived fairness. When one of these components fails, the currency loses its value.

Is there, in your opinion, such a thing as a “fair” currency, or is fairness always a question of how we use and redistribute money?

A “fair currency” can only exist within a fair economy. I would say that currency itself cannot be fair or unfair – but it can either reinforce or weaken inequalities. It depends on whom it serves. If access to financial services is universal and the rules apply to everyone, money can function as an instrument of equality. If these conditions aren’t met, money becomes an instrument of power.

We see this in practice – where trust in the fairness of the system is lost, there is more scope for tax evasion, shifting profits to tax havens and finding ways to escape the public framework. Inequalities then are not just an economic problem, but also a problem of basic trust. People who feel that the system isn’t fair then cease to accept its rules.

In our research, we show that trust – trust that tax obligations apply equally to everyone and that public resources are used effectively – is a key prerequisite for the stability not only of the monetary system, but of the entire democratic system. When this relationship is broken, we see greater support for populist and anti-system political parties, which only further weakens democratic institutions and leads to further increases in illegitimate economic inequality. We find ourselves not so much in a vicious circle as in a downward spiral.

Does economics have a recipe for preventing, stopping or reversing this spiral?

Economics gives us a clue as to the way out. This is through external intervention in the system, i.e. generally making changes that strengthen confidence in the system.

This is the only way to reverse the negative spiral – it can then become a spiral leading to positive development.

If you had to bet on what currency will be used in the Czech Republic in twenty years, what would you guess? The koruna, the euro, the digital euro, or something completely different?

Technologically, I think the digital euro is probably the most likely. But I’m convinced that the framework in which it will operate will be much more important than the currency itself. If the digital system is based on public trust, transparency and privacy protection, it can bring greater efficiency and security. However, if digitisation strengthens the concentration of power in the hands of a few companies or states, nothing will change in principle – only the form of money.

In other words, what is at stake is not the kind of money we’ll have, but whose money it will be. And this isn’t only an economic question, but also a democratic one.